As stock-lockup expirations loom, six of Facebook's top officers (but not Zuck) filed Form 4s today to notify the SEC their RSUs will vest into 45.3 million Class B shares on October 29th, but they won't be selling any. Facebook will withhold roughly 45% of those shares and keep them from the public market in exchange for paying the tax on those issued so executives don't have to pay taxes up front. The strategy should help keep the $FB price more stable as stock lock-ups expire and more shares hit the NASDAQ.

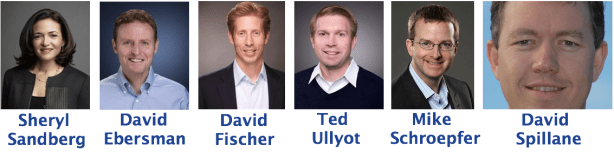

The employees filing Form 4s today are Sheryl Sandberg (COO), David Fischer (VP of ads), Mike Schroepfer aka Schrep (VP of engineering), David Ebersman (CFO) and David Spillane (Chief Accounting Officer), and Ted Ullyot (General Counsel). That's Facebook's entire Section 16 class of executives minus CEO Mark Zuckerberg. Zuck does not have RSUs and last month committed to not sell any shares for at least a year.

Facebook will withhold 21,143,119 of the Class B shares from these six employees, and in return will pay the tax on the 24,191,281 it gives them using a 50%-50% combination of cash and debt.

This is the same as Facebook does for all its employees. Otherwise newly vested shareholders would have to pay out of pocket for the taxes, which could be tough or encourage them to sell more of their stock right away. Facebook doesn't want any more stock flooding the market since its share price is only $21.94, well below its IPO price. Getting that price higher over time could help it recruit and retain talent, and this tax strategy should make that easier.

Sandberg, Fischer, Schroepfer, Ebersman, Spillane, and Ullyot become eligible to sell their shares four days after they actually vest on October 29th. There's no telling whether or not they'll sell any then, though. The six are surely well compensated with salary, so it might not be as necessary as it is for lower level employees.

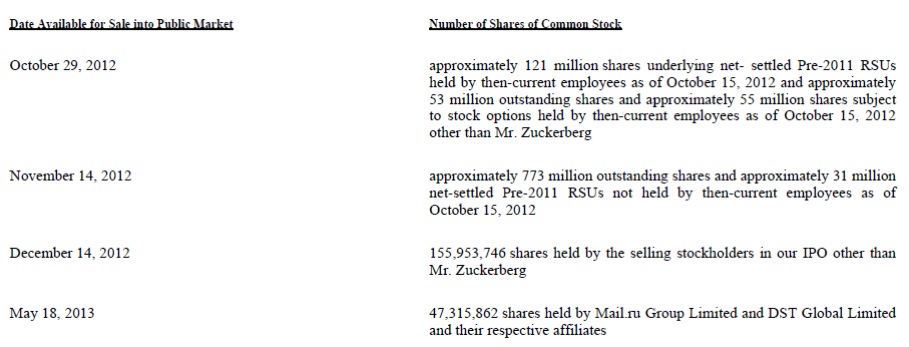

October 29th / November 2nd is when the next round up stock lock-up expirations and 271 million shares will vest (including these 45 million). Those not withheld for taxes will become eligible for sale. You might see Facebook's share price dip that day.

Facebook will then have to endure several more rounds including a huge one on November 14th where many employees will start getting their chance to sell their shares for cash on the NASDAQ. If lots of normal employees and some notable executives sell, or if masses of employees quit, it could shake confidence in the company and seriously hurt the share price.

Here's the full list of lock-up expiration dates, and we'll be watching to see if hope for Facebook's new revenue drivers can offset the downward pressure of the shares that will soon hit the market.

[Image Credit TechNet, Rentz/Getty/CNN]

No hay comentarios:

Publicar un comentario