It's day one of the new general solicitation rules allowing companies to openly advertise that they're fundraising, and betaworks is wasting no time. It's just emailed asking its thousands of Openbeta testers to invest in it through AngelList Syndicates. It's not the only one diving head-first into general solicitation, indicating the new rules will have a profound effect on startups.

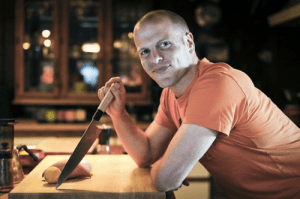

For example, best-selling "4-Hour Work Week" author Tim Ferriss just published a blog post titled "You'd Like to Be an Angel Investor? Here's How You Can Invest In My Deals" to his 1.4 million monthly readers. He's raising $250,000 via AngelList Syndicates for a startup called Shyp that will pick up, package, any loose item you want sent somewhere.

Some people I've talked to a bit suspicious of Ferriss' chops as a startup picker, but he has advised Uber and Evernote, plus invested somewhat early in Facebook and Twitter.

In an effort to avoid duping people and properly disclose risk, Ferriss tells readers that startup investing is a gamble, they should be comfortable losing what they invest, and do to investing right they should slowly build a portfolio. He also explain that investors will have to prove they're accredited (net work of over $1 million) when they register with AngelList.

Then he does something I expect we're going to see a lot of beside general solicitation: proving value-add.

Ferriss includes a section to help Shyp gain users, recruit employees, get press, and strategize expansion:

Ferriss includes a section to help Shyp gain users, recruit employees, get press, and strategize expansion:

Can't invest right now? No worries. If relevant, I'd love for your to consider any of the below actions. Shyp and I would really appreciate it!

- Apply to be a Shyp Hero (Heroes are Shyp's drivers).

- Apply for a job on Shyp's core team.

- Interview the co-founders of Shyp: Kevin, Josh, and Jack. They're clever gents. Just email: founders at shyp dot com.

-Tell Shyp which city you live inso they can launch there before others!

To get space in funding rounds, syndicate operators may need to demonstrate they can provide more than just money and advice. If Ferriss can help Shyp with the projects listed above, he may be able to convince other startups to let him run syndicates for them.

But back to betaworks, "a company that builds companies".

Previously it took venture capital from big firms and invested it in a slew of companies that it helped build and operate as well, including Digg, Chartbeat, bit.ly, and Dots. Now it's going to take capital from people in its Openbeta community of beta testers.

I've copied the email asking for investment below as I think it's a fascinating early example of something that might become quite common. You can also read more about their strategy on their blog.

One of the questions it's hoping to answer with the test is "Could users be more helpful to early-stage companies than venture investors are?" Really, that's the question General Solicitation as a whole poises. What I've gathered, a sentiment mirrored by AngelList co-founder Naval Ravikant, is that the best VCs aren't in danger of being displaced. Nothing beats the deep experience, mentorship, connections, and clout a top-tier firm or angel can bring.

But the bottom-of-the-barrel venture capitalists could find it much harder to find deals. If one person or a firm can't provide value beyond their money, why not take that money from an army of crowdsourced investors? It will take a few years for the impact of general solicitation to play out for startups, but with the popularity of general solicitation and AngelList Syndicates fresh out the gate, it's clear that fundraising is entering a whole new era.

From betaworks to its Openbeta testers:

Hey Openbeta -

Earlier this year we kicked off Openbeta to create a more open line of communication between betaworks and our community. In a very short period of time, it has become a place where thousands of people can try the early products we build and invest in, join us for events at the betaworks studio — and today, for the first time, invest alongside us in the companies we fall in love with.

We believe we're better at what we do — building and operating companies — because of our open ecosystem, so we've decided to take it a step further. Starting today, we're proud to announce that we'll start syndicating seed investments for our Openbeta users and community.

While this announcement comes on an important day for crowdfunding (with the lifting of the ban on general solicitation), it's something we've been thinking about for a long time. We think that in the next few months, as the crowdfunding regulations are fully implemented, this new funding environment will be hugely positive for startups and how they approach raising capital. Unfortunately, because the laws are still unclear, we can't yet discuss the specific investment we're syndicating, but we're excited to be doing this and to partner with AngelList to do it.

To invest in our syndicates, you must:

Be an Openbeta Member (you're already done!)

Be an accredited AngelList investor. Ultimately, we'd like to include a broader group, but existing regulations limit startup investing to accredited investors. We hope that as crowdfunding regulations progress, we will be able to include the entire Openbeta community, both accredited and non-accredited investors alike. Stay tuned

These new regulations combined with our announcement today marks a significant change for the technology industry, particularly for startups and venture capital. We're happy being smack in the middle of it and we're thrilled that you've chosen to join us in this journey. You can read more about our thought process in the full blog post here, and if you have any additional questions you can reach out to me directly at [redacted]

- Nick

AngelList is a community of startups and investors who make fund-raising efficient. Started by the dudes who do Venture Hacks. Meet the startups and investors. As of March 22 2011, approximately 275 startups and 417 investors have raised money and invested via AngelList.

Founded in 2008, betaworks is a company of builders. A tightly linked network of ideas, people, capital, products and data brought together in imaginative ways to build out a more connected world. At first glance we seem to do many things. But first and foremost, we're builders, seeking to create a more sustainable innovation model. The more we build, the more we learn, the more we get ideas for peripheral things, all related, connected – in a loosely...

Tim Ferriss is a start-up angel investor (Twitter, Posterous, RescueTime, and others), blogger, and entrepreneur. His best-known written work is The 4-Hour Workweek, which had been sold into 35 languages and reached #1 on The New York Times, BusinessWeek, and The Wall Street Journal bestseller lists. On May 3, 2009, it celebrated its 2nd straight year on The New York Times business bestseller list since its publication on April 27, 2007. Tim is also a guest lecturer at Princeton...

No hay comentarios:

Publicar un comentario