Widely heralded as a victory for Google, the recent outcome of the American Federal Trade Commission's exhaustive 19-month investigation into allegations of anti-competitive practices nevertheless contains at least one point that should have some (minor but beneficial) impact on the PPC marketplace in the near future.

Widely heralded as a victory for Google, the recent outcome of the American Federal Trade Commission's exhaustive 19-month investigation into allegations of anti-competitive practices nevertheless contains at least one point that should have some (minor but beneficial) impact on the PPC marketplace in the near future.

Firstly though, the meat of the investigation was the allegation, prompted and lobbied for by, among others, fairsearch.org, a group of companies including Microsoft, Expedia, and Foundem, all of which have been severely impacted by the meteoric growth of Google in the past decade – that Google had been unfairly manipulating search results to promote its own 'vertical' services such as Shopping and Maps to the detriment of their competition.

Without a doubt, Google's dominance is near to absolute in some regions. Though Yahoo/Bing are somewhat holding back the tide for now in the US, where Google has 'only' a 70% market share, elsewhere across the globe the search engine war feels like it's almost over, with 90% of searches in the UK being done via Google.

There are only a handful of the top markets in which Google not yet taken over, notably China, Japan, Russia and Korea.

However, having a monopoly is in itself not illegal, so long as such domination has not come about via purposefully anti-competitive tactics.

It is this issue that has tripped up Microsoft themselves in the past. When it was penalised under antitrust law for unfair manipulation of the browser wars, it was because this success was seen to be not a consequence of the inherent superiority of Internet Explorer, but because IE was coming pre-installed along with copies of Windows.

In contrast, the commission's final verdict on Google recognises that it can be legitimately argued that the search behemoth really is just giving people what they want, and there is nothing stopping any internet user from clicking away and using rival services.

While certain competitors will be suffering, the marketplace and consumers are not.

So, although half a dozen US state investigations and an independent European inquiry are still ongoing, for the time being it is largely business as usual, much to the disappointment of Microsoft and others who were hoping for fines and full legal proceedings to commence.

More immediately impactful are the outcomes relating to some of the lesser charge. Even these can't exactly been seen as heavy blows against Google's might, since the actions to be taken by the American multinational are at this stage entirely voluntary and non-binding.

The change most likely to have direct impact on the activities of the everyday PPC marketer are those relating to the Google AdWords API, or Application Programming Interface, which can be used via third party software to generate reports or directly manage campaign activity.

The common practice at present is to create a PPC campaign within AdWords, and then export that campaign to other platforms such as Bing Ads, a somewhat arduous (some might say torturous) process depending on the target platform, that given the relatively low search volumes of some of these networks, can be seen as not worth the pain.

Until now, Google have restricted competitors' usage of its API, but this has now been judged to be anti-competitive, as the added burden of managing similar campaigns across multiple platforms may have dissuaded some advertisers from bothering to venture beyond Google.

The relaxed T&C's regarding the API (to come into effect within the next two months) may open up the way for campaigns to be automatically copied across platforms, and automatically kept in sync with each other, which would be a massive blessing for PPCers.

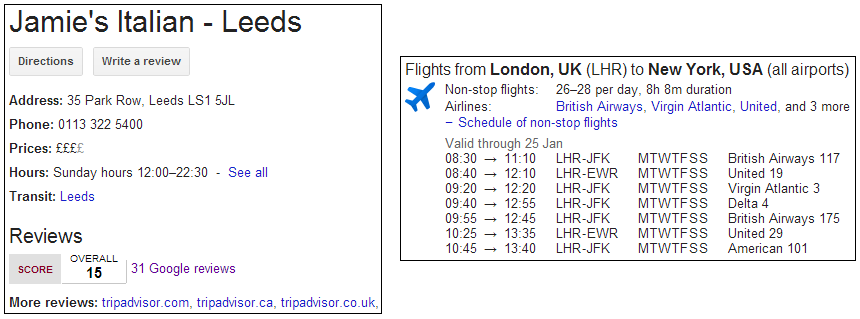

Another of the complaints was regarding Google's practice of scraping third-party sites and passing off snippets of their content as their own, such as shopping, restaurant and other business reviews and star ratings.

This has upset consumer review website Yelp and comparison shopping website Nextag. Google has also done the same with flight times, which has hurt the likes of Kayak, Expedia, and Travelocity:

In fact, Google had already scaled back this practice, but in addition to that it will also shortly (within the next three months) be introducing a form which will allow websites to opt-out of being crawled for this purpose (without affecting the ordinary search ranking).

In reality, not much will change when it comes to the end-user experience.

The final ruling concerns mobile patents. It is also unlikely to have much immediate or noticeable impact on the general public. In 2012, Google acquired Motorola Mobility, which brought with it some tens of thousands of patents covering wireless and other internet technologies.

The FTC ruled that Google unreasonably refused to grant licenses to some mobile-device competitors and sought court injunctions to stop their products from being sold. They argued that such behaviour could lead to higher prices for consumers as companies paying higher royalties to Google for use of their patents would inevitably pass on these increased costs to their customers.

So all in all, very little will change for end-users, though I'm hopeful of some improvement to the way we'll be able to manage non-Google campaigns in the future due to the API changes. So Google wins (as do its users, if not its competitors).

Read Google's response on the FTC's ruling here.

Pete Whitmarsh is PPC Manager at Search Laboratory and a guest blogger on Econsultancy.

No hay comentarios:

Publicar un comentario