No, this isn't a guest column by Aaron Levie. Though he and his startup Box, the poster child of the "sexy enterprise," are definitely included in the bunch. "You should definitely kick Aaron off the list. Just to mess with him," Zendesk founder Mikkel Svane commented when he heard what we were writing.

With VCs voting with their feet and eschewing consumer startups this play period, we're seeing a major shift of sentiment and momentum to enterprise startups. Perhaps the most major in a while, definitely as far as we can remember. Venture money that a year ago was going into consumer deals is now flowing into enterprise, as the Series A crunch and reticence about Facebook's lackluster IPO has dampened investor enthusiasm for photosharing apps and their ilk.

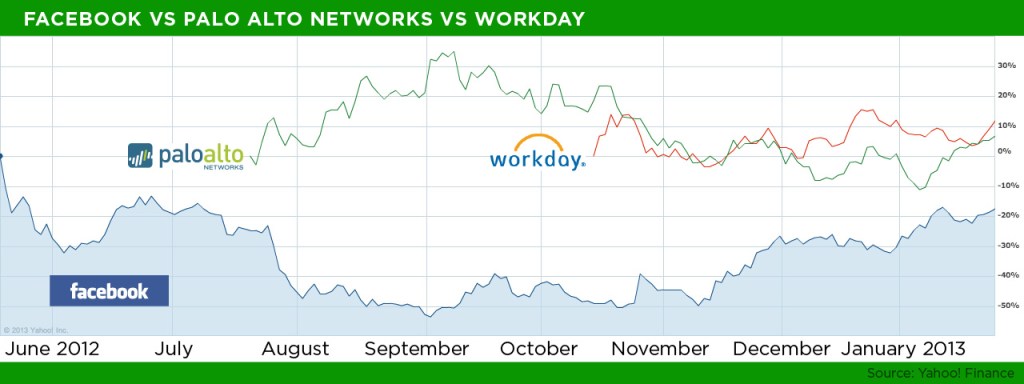

In contrast to Facebook, a series of stellar enterprise IPOs like Palo Alto Networks, Splunk and (perhaps the original enterprise cool kid) Workday have fired the collective entrepreneurial imagination. "We see entrepreneurs come in every other day telling us how they're going to reinvent Splunk," Sequoia's Aaref Hilaly tells me. "The successful enterprise IPOs serve as beacons for the companies that come after them."

Although the VC profits baseline has traditionally come from enterprise deals, they certainly weren't media darlings. Consumer startups, despite their high beta and tendency to be outliers, were the bell of the mainstream tech blog ball. "Consumer technology tends to create fewer winners. Its easier to keep track of what a Facebook or a Twitter may be doing than myriad enterprise software vendors," NetSuite CEO Zach Nelson notes. "[There it] may take decades to decide the actual winners."

But the hype is changing. Conversations about "the next Instagram" at Coupa, The Creamery or on Caltrain have been replaced with staid assessments about the future of Big Data, storage and the cloud. The mobile, social, local gold rush of 2011 has been put on pause, at least as far as consumer Internet is concerned. VCs are staffing up with enterprise experts to handle the sharp shift in focus. We've even heard someone was working on something described only as, "a Path for enterprise."

While the phenomenon is recent enough that the exact flow of investment dollars from consumer to enterprise has yet to be captured in a study, the data points are beginning to pop up. For example 2012 was the first year in First Round Capital's history in which consumer companies were less than 50 percent of investment dollars, according to a report it published this week. Expect to see many more of these sorts of reports. And more enterprise coverage on TechCrunch.

Enterprise startups are finally the cool kids. Née, sexy.

"I would say the market is schizophrenic," says Marc Andreessen, on why Workday > Facebook might not mean the end of investor interest in social. "Right now we are in an era where the market wants enterprise companies. I am just saying, 'Wait a year, that will flip again; wait another year after that, that will flip again.'"

For now it's enterprise's time to shine. Due to the ubiquity of mobile computing, the cloud and the Bring Your Own Device movement, the lines are blurring between enterprise startups and consumer startups. Is Google Apps an enterprise product? Is Dropbox? Is Evernote? With an increasing proliferation of these sorts of enterprisumer startups, we're a far cry from the IBM SAGE era, where the only computing customers were literally big businesses.

In the past everything was top down. Large corporations and the government spent a lot of money on R&D, and technologies developed in that R&D like the mainframe/computer, the color TV and even the Internet would trickle down from large institutions to the mainstream user. Once these products hit the mainstream, the gravitational pull of the mainstream and its purchasing power slowly changed the adoption cycle from top down to bottom up.

"Consumers can make buying decisions much more quickly than businesses can," Andreessen points, "because for the consumer, they either like it or they don't, whereas businesses have to go through these long and involved processes." He maintains that the reason the enterprise wasn't particularly appealing for many entrepreneurs between 2000-2008 was that consumer software was the only software that anybody could adopt." This is no longer the case, as the enterprise world evolves from a sales-driven to a product-driven approach.

"The user is now the buyer, and the center of gravity is no longer in IT, it's actually in the line of business themselves," says Christian Gheorghe, CEO of mobile first metrics management startup Tidemark, outlining the factors in that evolution. "The cloud is not just a cost-based improvement, but a new computational platform. And mobile is surpassing the desktop."

"The demand for 'consumer-grade' enterprise technologies — from the standpoint of having strong UX, being mobile, and platform agnostic — is an irreversible trend," says Levie. "To the point that hard-to-use enterprise software will soon become more surprising than well-designed enterprise software (give it a few years)."

"Today all the consumerized enterprise stuff is as easily usable by the small business as it is by the large business," Andreessen explains. "In fact, it's probably more easily usable by the small business than it is by the large business, because with a small business, it's like you can just use it. You don't have to go through a long process, you don't have to have a lot of meetings, you don't have to have committees, you don't have to have all this stuff. You can just start picking up and using it."

Because of this confluence of elements, an enterprise startup's "land and expand" strategy has become more complex than having a huge sales force or wining and dining the CIO. It actually boils down to making a product that people want to use, as consumers are already using cloud products, and fall back on them when their older enterprise solutions fail.

"The Exchange Server is down? No problem, I'll use Gmail. Email policy doesn't allow an attachment over 2 GB. No problem, I'll use YouSendIt, Dropbox or Box," Ron Miller succinctly puts it. Box's early business customers were CIOs who called into the company with concerns about security, irate that their employees were using the platform to covertly share files. Those calls eventually turned into deals. In fact, one could argue that consumer startup Dropbox was the best thing to ever happened to Box, familiarizing the layman with cloud file sharing. Box then innovated on the use case, by offering increased security and controls to appease CIOs and enterprise execs.

"The first generation of this new enterprise wave was replacement technologies at lower prices (like Salesforce and SolarWinds)," says Asana co-founder Justin Rosenstein, "but the new wave is technologies that compete by being better products. The *new* inefficiency to compete against isn't just total cost of operations (through SaaS) or cost – it's beating them with a better product."

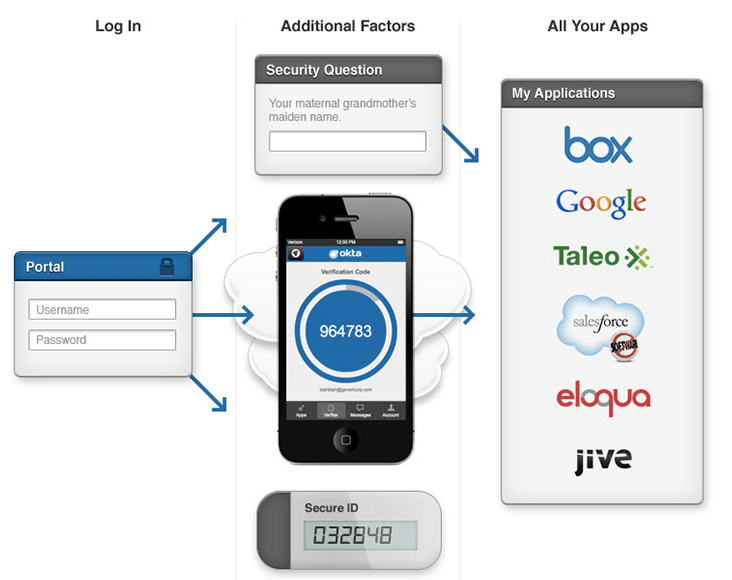

Because adoption is getting easier and other related factors, we're seeing an onslaught of entrepreneurs building products for businesses that employees actually can use or want to use. We're even seeing the emergence of companies like Okta, which are enterprise only, but still display the ease of a consumer startup. Not only is the number of companies that are taking their design cues from the consumer Internet increasing, it is rapidly becoming the norm.

"'Enterprise sexiness' has come from the increasing awareness that the new breed of vendors have gotten the consumerization thing right (especially with UI and mobile), and that the business models are known to be sustainable and viable," says Workday co-founder Aneel Bhusri. "Indeed, in the case of companies like Asana and Cloudera, some of the founders themselves came from the consumer Internet."

That consumer background is helping the companies below get a lot more notice from VCs to consumers to the media because they know how to pitch themselves — and yes many of them have pretty cool products, specifically targeting millennials just getting situated in the workforce. PeopleSoft, Aol's HRM software, is as atrocious to use as its name sounds — I'd much rather be using Workday.

While this list is by no means comprehensive (there are a ton of cool enterprise startups, and most people are vehement favorites), here are just a few of the new guard that are fast becoming household names — through their focus on intuitiveness and design, awareness of mobile and fresh approaches to decades-old problems. "The existing enterprise players are building software people tolerate," as Rosenstein concisely puts it. "The future players are building software people love."

Okta

Okta is a single sign-on service for companies — "Facebook Connect" for the enterprise. As a user, you can log in to your company's admin page and access both private data hosted on your company's server (intranet) and data from cloud products like Box, Salesforce and Google Apps. Administrators can easily manage the credentials across various applications and devices.

Competitors: Salesforce has just launched Salesforce Identity to compete directly with Okta.

Secret sauce: Okta is compatible with every web app you can think of. The startup has raised $52.5 million in funding from Greylock Partners, Khosla Ventures, Andreessen Horowitz, FLOODGATE and Sequoia.

Cloudera

Cloudera is the solution de jour for managing big data in a company, offering software, services and support for databases. When a user needs to analyze raw data to find a trend or to see if they can find valuable answers in unused data, Cloudera (built on top of Hadoop) allows them to complete more efficient queries.

Competitors: MapR and Hortonworks, but they are much smaller. For big companies, they can ask for custom solutions from IBM, but it's a lot more expensive.

Secret sauce: Timing and it handles everything (software, development, support…). Cloudera has big funding as well, having raised $141 million from Greylock, Accel, Meritech Capital Partners, In-Q-Tel and others.

Box

The original "sexy" enterprise startup, Box allows you to store, manage and collaborate on your documents in the cloud. Founded back in 2006 (before Dropbox!), the company is helmed by the colorful Aaron Levie. Like Okta, Box's main advantage is that it integrates well with many enterprise apps and offers security in addition to collaboration functionality. Interoperability is crucial: Users can find their files uploaded to Box in their favorite CRM apps, etc.

Competitors: Microsoft SharePoint, consumer products, Dropbox, Google Drive…

Secret sauce: It was there first! Box effectively competes by constantly iterating on its product, focusing on enterprise even when Dropbox caught on, and good partnerships. Box has thus far raised $284 million from Draper Fisher Jurvetson, Scale Venture Partners, Andreessen Horowitz and others.

GitHub

Developers need a place to track and share their code changes, and GitHub, with social coding features that make it really easy for open source projects, is the repository of choice. GitHub is so popular that its version control technology, Git, is replacing SVN based on merit. GitHub offers premium subscriptions and self-hosted versions, and many companies and startups have switched to private GitHub repositories, some very early (Spotify).

Competitors: Google Code for the social coding aspect, self-hosted repositories on an Intranet.

Secret sauce: Git. Git is such an ace technology that developers couldn't resist adopting it, and GitHub is *the* best way to use Git. The runner up in the Bootstrapped Startup category at the 2011 Crunchies, GitHub eventually relented and took $100 million in Series A funding from Andreessen Horowitz last year.

Zendesk

Zendesk is user-friendly help desk software that allows companies to handle support requests in bulk. Zendesk is IPO-bound and, like enterprise pal Workday, might be another point of light in a series of lackluster tech IPOs.

Competitors: Tons of companies are building desk software, and there are many open source apps for small and medium companies. Desk.com (formerly Assistly, acquired by Salesforce) and Tender Support are quite popular, but Tender Support doesn't have the same breadth of resources as Zendesk.

Secret sauce: Zendesk was the first modern help desk, but Desk.com is gaining a lot of traction with Salesforce behind it. The company has plenty of money in the bank, having raised $85.5 million from Charles River Ventures, Benchmark Capital, Matrix Partners, Redpoint Ventures, Index Ventures, GGV Capital, Goldman Sachs and Silicon Valley Bank.

Asana

Taking the lessons they learned from an early stint at Facebook, Asana co-founders Dustin Moskovitz and Justin Rosenstein have built a beautiful and streamlined collaboration tool with a focus on to-do lists. The interface is flexible and easy to understand. In Asana, everything is a to-do item. The platform doesn't try to do it all, but its design is very very intuitive, adhering humbly to its core goal of easing communications within a team.

Competitors: Basecamp from 37signals, Do.com from Salesforce, and other communication tools that may make it useless (think Yammer) and many small alternatives (Producteev, Flow, etc.). For all these companies, the closest competitor might be basic emails.

Secret sauce: The Asana product is relatively easy to use, and this is important for a latecomer to the collaboration software space. Pricing is friendly, too. For small companies, many of which have yet to switch to a collaboration tool, you can basically use it for free. Asana has raised over 38.2 million from Peter Thiel, Founders Fund Benchmark Capital, Andreessen Horowitz and angels like Ron Conway and Adam D'Angelo.

GoodData

GoodData is a less expensive data-analytics solution for large companies. Companies can integrate GoodData's platform into their own cloud-based SaaS products (i.e. Salesforce, Zendesk) and then access operational dashboards, data warehousing and advanced data reporting.

Competitors: IBM, SAP and Oracle.

Secret sauce: Cheaper than competitors, GoodData integrates easily with Zendesk and Salesforce to track, aggregate and analyze data. Its simplicity and "out of the box" integrations make it ideal for small and medium enterprises. GoodData has $53.5 million in funding from Andreessen Horowitz, General Catalyst Partners, Tim O'Reilly and others.

Atlassian

"The coolest thing to come out of Australia," according to Accel's Ping Li, Atlassian is low-cost project management software. It provides a series of enterprise web apps: Jira is a project-tracking tool focused on software development; Confluence is a more traditional collaboration and communication tool; and developers use many of its other smaller product offerings in their workflows. Finally, Atlassian acquired HipChat, a hip chat app.

Competitors: Open source project management solutions and native apps compete with Jira. Confluence competes with Basecamp, Yammer, etc. HipChat competes with Campfire from 37signals.

Secret sauce: Founded in 2002, Atlassian is not a kid anymore. Over the years, it has proved to be a reliable web app developer. The company has thus far raised $60 million in Series A solely from Accel Partners.

Nimble Storage

Nimble Storage is an online storage service for developers. It has found a way to provide a large storage capacity with 5x the performance and 5x the capacity as existing products from EMC and NetApp. Nimble Storage has a unique caching system based on the flash storage commonly found in PCs and mobile phones. The result is a great speed increase, comparable to putting an SSD drive in your old computer. That technology is patented for online data storage.

Competitors: EMC, NetApp, Amazon S3 and other online storage solutions.

Secret sauce: Improving read/write speeds is a great challenge for hosting solutions these days, and Nimble is faster than its competitors, yet costs the same. It has received $81.7 million in funding from Sequoia Capital, Accel Partners, Lightspeed Venture Partners and others.

MobileIron

MobileIron is a device management tool for system admins. Now that the BYOD trend is taking over businesses, admins have to find new ways to handle security settings and push mobile apps to employees — all of this across multiple phones, tablets and operating systems. MobileIron provides a single platform to manage all devices even though most of them are personal devices that employees bring to the workplace.

Competitors: In-house solutions and restrictions, checking security settings one phone at a time or choosing not to care about security.

Secret sauce: MobileIron makes it much easier for system admins to handle custom phone settings. If you convert one system admin, the entire company will switch to MobileIron. Since 2007, it has raised $96.8 million from Sequoia Capital, Storm Ventures and Norwest Venture Partners.

"They are all basically new companies," says Andreessen, who agreed with many of the "Cool Kids" choices. "I think who is not on that list are all the existing companies that sell business software." And being younger, more agile companies automatically makes them much more interesting. For anyone who's read my post about SAP buying SuccessFactors, and misunderstood it, it's not SuccessFactors that was boring (it's not at all) but SAP — whose stock performance is positively reflecting its acquisitions of hipper players like SuccessFactors — itself.

"The joke about SAP has always been, it's making 50s German manufacturing methodology, implemented in 1960s software technology, delivered to 1970-style manufacturing organizations," says Andreessen. "The incumbency — they are still the lingering hangover from the dot-com crash."

"We all secretly fear making the same mistakes as previous-generation enterprise software companies — bloating our products and building out costly sales operations," says Zendesk's Svane. "The new enterprise software companies that avoid these traps will be tomorrow's winners."

So I was wrong, at least on a macro level: Perhaps there is no more compelling story in technology today than the David versus Goliath tale of enterprise upheaval. "Today is the most exciting time in enterprise technology history…" SuccessFactors CEO himself Lars Dalgaard shares, "and we get to have no excuses for building a delicious user experience for everything we launch. Our benchmark is more delicious looking than Apple, simpler than Twitter."

And investors, public and private, increasingly agree: Being that we're in a consumer rut, am I going to be writing about the enterprise for the next two years?

The advantage of the consumer businesses is they tend to be much broader-based with a much larger number of customers and relatively faster adoption patterns. The advantage of the enterprise companies is that they have revenue numbers off the bat if they're good, and thus they are not as subject to consumer trends, fads or behavior, which is why investors, having raised less money to invest in 2013 in the first place, are being cautious.

"Folks have realized that businesses buy close to $300 billion worth of software ($285 billion according to Gartner in 2012)," says Rosenstein, "and that companies who exhibit those attributes have the potential to build *very* large businesses. This is compounded by the opportunity to grow very quickly, since the economics of scaling a software business have been forever changed by things like Amazon on the backend, and self-service sales on the frontend."

"The businesses are good, which is nice," Andreessen adds, "and then I think it's also sector rotation. We talk to a lot of the big hedge funds, mutual funds. It's really funny. We are talking about big hedge funds, mutual funds — about six months ago they all started saying, well, you know, we really think there is going to be a rotation from consumer and enterprise and we are going to really get ahead of that. And I am like, yeah, you and 10 other guys in the last two weeks have told me the same thing. It's like, good job, like you are way out ahead on the leading edge on this."

You have to give credit to the foresight of the Levies, Bhusris, Svanes of the world who took a bet on enterprise when it wasn't the new girl in school. And, especially, the Ellisons and Benioffs for building the school. In fact, there is a salacious rumor making the rounds that Levie actually has a picture of Ellison as his iPhone home screen. "No comment," he says.

As DFJ partner Andreas Stavropoulos brings up, "Interestingly, enterprise companies like Box that are gaining traction now were started in 2004-2007 when it wasn't cool to be enterprise-focused. This shows some of the best innovations happen when most of the market is looking the other way."

"My running joke has been, it's like little kids," says Andreessen. "Like everybody out of the consumer pool, everybody into the enterprise pool. So everybody out of the wading pool, everybody into the hot tub."

And right now the enterprise is a pretty hot hot tub.

Additional reporting by Romain Dillet, Alex Williams and Leena Rao. Images by Bryce Durbin. You can read more on the riveting world of enterprise computing in "Marc Andreessen On The Future Of Enterprise."

- BOX

- OKTA

- NIMBLE STORAGE

- CLOUDERA

- ZENDESK

- ASANA

- GOODDATA

- MOBILEIRON

- MARC ANDREESSEN

- AARON LEVIE

- MIKKEL SVANE

- JUSTIN ROSENSTEIN

- ANEEL BHUSRI

- WORKDAY

- ANDREAS STAVROPOULOS

After starting as a college business project in 2005, Box was officially launched in March of 2006 with the vision of connecting people, devices and networks. Box provides more than 8 million users with secure cloud content management and collaboration. They say their platform "allows personal and commercial content to be accessible, sharable, and storable in any format from anywhere".

Okta is an enterprise-grade identity management service, built from the ground up in the cloud and designed to address the challenges of a cloud, mobile and interconnected business world. Okta integrates with existing directories and identity systems, as well as thousands of on-premises, cloud-based and mobile applications, to enable IT to securely manage access anywhere, anytime and from any device. More than 200 enterprises, including Allergan, BMC Software, Clorox, LinkedIn, T.D. Williamson and SAP, use Okta to increase security and...

Nimble Storage solutions are built on the idea that enterprises should not have to compromise between performance, capacity, ease of management, and price. Nimble's patented Cache Accelerated Sequential Layout (CASL) architecture, designed from the ground up to effectively combine flash with high capacity drives, makes high performance affordable, simplifies and enhances disaster recovery and backup, and delivers stress-free operations. Nimble Storage is funded by Sequoia Capital, Accel Partners and Lightspeed Venture Partners.

Cloudera, the commercial Hadoop company, develops and distributes Hadoop, the open source software that powers the data processing engines of the world's largest and most popular web sites. Founded by leading experts on big data from Facebook, Google, Oracle and Yahoo, Cloudera's mission is to bring the power of Hadoop, MapReduce, and distributed storage to companies of all sizes in the enterprise, Internet and government sectors. Headquartered in Silicon Valley, Cloudera has financial backing from Accel Partners, Greylock Partners...

Zendesk provides an integrated on-demand helpdesk - customer support portal solution based on the latest Web 2.0 technologies and design philosophies. The product has an elegant, minimalist design implemented in Ruby on Rails and provides seamless integration of the back-end helpdesk SaaS to a company's online customer-facing web presence, including hosted support email-ticket integration, online forums, RSS and widgets. This is unusual, because most SaaS helpdesk solutions focus exclusively on the backend helpdesk and treat the Web as...

Asana is a web application that keeps teams in sync - a single place for everyone to quickly capture, organize, track and communicate what they are working on. It was founded by Dustin Moskovitz, a co-founder of Facebook, and Justin Rosenstein, an alum of both Facebook and Google.

GoodData provides a cloud-based platform that enables more than 6,000 global businesses to monetize big data. GoodData is headquartered in San Francisco and is backed by Andreessen Horowitz, General Catalyst Partners, Fidelity Growth Partners, Next World Capital, Tenaya Capital and Windcrest Partners.

Mr. Marc Andreessen is a co-founder and general partner of the venture capital firm, Andreessen Horowitz. He is also co-founder and chairman of Ning and an investor in several startups including Digg, Plazes, and Twitter. He is an active member of the blogging community. Previously, Andreessen developed Mosaic and co-founded Netscape. Mosaic was developed at National Center for Supercomputing Applications, on which Andreessen was the team-leader. Andreessen co-founded what later became Netscape Communications which produced the 'Netscape Navigator'. Netscape Navigator...

Aaron Levie co-founded Box with friend and Box CFO Dylan Smith in 2005. The Box mission is to provide businesses and individuals with the simplest solution to share, access and manage their information. Aaron is the visionary behind Box's product and platform strategy, which is focused on incorporating the best of traditional content management with an easy to use user experience suited to the way people collaborate and work today. Box is one of the fastest growing companies in...

Justin Rosenstein is the co-founder of Asana, along with Facebook co-founder Dustin Moskovitz. Asana's software enables organizations to coordinate their people and teams without effort, providing key communication infrastructure to companies like Twitter, Airbnb, and Foursquare. Justin has led the development of products that hundreds of millions of people use daily. At Facebook, he was the tech lead for projects including the Like button and Facebook Pages, and designed the in-house project management system that Facebook relies on to this...

Aneel Bhusri is a Partner at Greylock and Co-Founder and Co-Chief Executive at Workday. Aneel joined Greylock in 1999 from PeopleSoft, where he was named vice chairman after several years as the company's senior vice president in charge of product strategy, business development and marketing. At PeopleSoft, he was responsible for developing and guiding all product strategy, corporate and product marketing. He also led the company's business development efforts in key areas such as new product development, vertical market initiatives and...

Workday is the leader in SaaS-based enterprise solutions for human resources, payroll and financial management, providing new levels of business agility for a fraction of the cost of buying, deploying and maintaining legacy on-premise systems. More than 130 customers, spanning mid-sized organizations to global Fortune 500 businesses, have selected Workday. Workday Human Capital Management and Workday Financial Management use modern, standards-based technologies to provide an unparalleled level of agility, ease-of-use, and integration capability. For more information...

"Andreas is a Managing Director at Draper Fisher Jurvetson, where, in addition to the TrustedID Board, he serves on the Boards of Akimbo, AppStream, everdream, H5 Technologies, MeetUp, Mobile 365, Pronto Networks, SilverPop, Technorati and Wavemarket. In addition, he led the firm's investments in Centerpost, ePocrates, 4info, Mimeo and Polaris Wireless. Andreas focuses primarily on software investments (enterprise infrastructure and consumer/internet), wireless networking, and technology-enabled services. Prior to joining DFJ, Mr. Stavropoulos was with McKinsey & Company's San Francisco...

No hay comentarios:

Publicar un comentario