For startups and small businesses, providing and managing employee insurance and benefits can be a huge headache. In the early stages of business development, this responsibility generally falls into the hands of founders, who have to contact insurance brokers and manage the whole enrollment process themselves. It's tedious and distracting, yes, but it's also a critical part of running a business — and ensuring that your employees are happy, healthy and productive.

After experiencing this painful process twice (as a co-founder of Wikinvest and, again, at SigFig), Parker Conrad decided founders had been subjected to enough pain and set out to build a solution — "the product I wish had been available the first two times around," he says. After recruiting Laks Srini, who had been a fellow software engineer SigFig, the two co-founded Zenefits to help startups and small businesses find insurance quotes and manage employee benefits in one place.

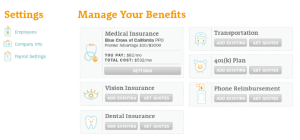

A member of Y Combinator's Winter 2013 class, Zenefits is officially launching today with a platform that aims to help SMBs more quickly and painlessly set up health insurance and ancillary benefits for their employees, whether it be medical, dental, vision or their 401(k) plans. The process often takes weeks, requiring co-founders or unlucky staffers to contact brokers for quotes and manage the tedious enrollment process themselves, which usually involves dozens of trips to a fax machine (a what?!) and sorting through stacks of paper forms for each employee.

Instead of having to print PDFs, fill them out, sign them and fax them back each time that something changes within an individual employee's plan, Zenefits wants to turn that multi-week, paper-filled process into one that can happen in just a few minutes from the comfort of your local browser — even the actual signing of those forms.

To help bring benefit enrollment and management online, Zenefits allows companies that use ADP, Intuit or Zen Payroll to log in with their existing online credentials and use its system to import relevant employee data, email relevant forms and applications to all of their employees and even send them reminders. From that point on, employees can manage their benefits through Zenefits directly, without having to sign in to 17 different systems.

By choosing to sync their payroll system with the Zenefits platform (which, by the way, is optional, not required), companies can automatically import insurance and benefits information so that the system can set up employee deductions in the payroll system when someone enrolls in or changes their plan and monitor for arriving (and departing) employees so that Zenefits can work directly with them to get them enrolled (or dis-enrolled).

In the big picture, Zenefits is out to disrupt alternative to traditional insurance brokers, who generally force their clients to use PDFs and fax machines to manage their health insurance benefits and less-than-stellar administrative services. Not only that, but many startups opt to use HR outsourcing firms like TriNet for benefits administration, but these services tend to charge thousands of dollars per employee (per year), something Zenefits offers for free. So Zenefits wants to present a better alternative to outsourcing firms as well.

Conrad also sees a big market opportunity thanks to some of the new provisions inherent to the recently-passed Obamacare. Traditionally, health insurance brokers make 7 percent of health insurance premiums (in California, for example), which averages out to about $10,500/employee. However, these commissions will likely come down in 2014 due to the minimum loss ration provisions in Obamacare and brokers are saying that they will stop working with smaller companies or, at the very least, begin charging for what used to be a free service, Conrad says.

"Even if commissions come down," the co-founder continues, "we think brokers still make too much money, so we want to offer a wide range of supplementary services for free to justify and earn our commission."

"Even if commissions come down," the co-founder continues, "we think brokers still make too much money, so we want to offer a wide range of supplementary services for free to justify and earn our commission."

This means that, going forward, Zenefits will look to round offer an increasing number of ancillary services, like transportation benefits and 401(k) management, for free. While there are in fact other pre-tax benefit companies out there, as players like WageWorks sell commuter benefits at $5/employee/month, for example, Zenefits is in the process of adding the same functionality for free, making its money instead on health insurance commissions. Currently, Zenefits offers support for 401(k) management and plans to add transportation and cell phone benefit management in the near future.

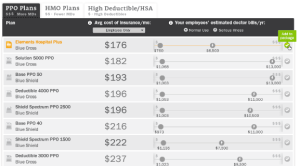

At launch, Zenefits' platform includes plans from every major carrier in California (hundreds in total) and is in the process of adding more. It also offers instant quotes once a user signs up, which should be welcome news to those using insurance brokers, which tend to take at least a few business days to get that information from the insurance carrier.

Of course, while this kind of idea has a lot of appeal, Zenefits also happens to be working in a space that's already occupied by startups like Cake Health and Simplee, which are both trying to make it easy for companies to manage and understand health care expenses (and reduce costs). But, by offering instant quotes, payroll integration and ancillary services for free, the Zenefits co-founders think that they have a leg up on the competition.

More on Zenefits at home here or in their intro video below:

No hay comentarios:

Publicar un comentario