One of the biggest challenges many entreprenuers face is finding the right technical partner when building a company. Some startups can have a single leader, but more often than not, there is a balanced team behind every successful business.

Ooga Labs founders Stan Chudnovsky and James Currier began their partnership when Currier moved Emode, the business he started with BranchOut founder Rick Marini, to San Francisco in 2000. A recent business school grad, Currier realized very quickly that he needed an engineering leader to help him grow the company. August Capital partner David Hornik (then-partner Andrew Ankur had just invested in the company) set Chudnovsky, a talented engineer, and Currier up on a quasi-blind date at the Penn Dragon Cafe in Hayes Valley in 2001, and soon after Chudnovsky joined Currier and Marini on their journey to create an online testing company.

More than 10 years later, Chudnovsky and Currier are still partners, but have taken a different direction. The pair run and operate Ooga Labs, a startup studio and product-focused investment vehicle, that has backed Flickr, SecondLife, Path, Wanelo, and Lyft, among others. With the growing number of company builders and studios emerging, it's clear that Currier and Chudnovsky are early pioneers in this movement.

The Tickle Effect

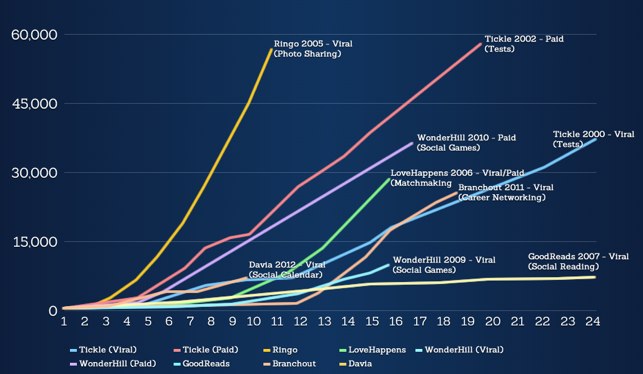

Back in 2001, Currier, Marini and Chudnovsky continued to chug along despite the bubble bursting and the weak climate for startups. They tried a number of ways to reinvigorate the product, including changing Emode's name to Tickle. Currier says that the testing application didn't have a ton of retention and people wouldn't stay on the site, and he quickly realized that they needed to build a system that had a network effect. So Tickle became more of a social network, pivoting slightly to a matchmaking service based on IQ and other tests.

Within two years the startup became profitable and made the cover of Business 2.0 magazine. "It was during this period when we realized about the power of network effect," says Currier. Tickle sold to Monster in 2004 for around $110 million. Currier stayed on to run the division of Monster for two years and when he departed, Chudnovsky ran the same group.

Following the acquisition, Currier and Chudnovsky were starting to think about how to enter the investing world and it made sense to continue the partnership together under Ooga Labs. Both felt that their skills and value-add complemented each other. They rarely fought, and when they do they always end up arguing to the point where they forget what they were fighting about. One of the newly formed firm's first investments was Flickr in 2004, and turned out to be immediately successful as the photo sharing site sold to Yahoo in 2005 for $35 million.

A Network-Focused Investor

From the start, Currier and Chudnovsky knew they wanted to differentiate themselves as investors. First, the duo chose to focus on being product-driven advisors and investors. "I had a sense of what being a VC was like when working as an associate at Battery Ventures and I didn't want that. But I also didn't want to jump in with one company. We love working on product and design. That's where Stan and I live," explains Currier. Part of owning product as an investor also gives Currier and Chudnovsky the advantage when it comes to giving entrepreneurs value-add beyond just a check.

Second, Ooga only focuses on investing in networks and marketplaces (the one exception to this rule says Currier is PandoDaily, the technology news site started by former TechCrunch editor Sarah Lacy). Currier and Chudnovsky both decided that their expertise from creating an early social network at Tickle gave them skills and knowledge they could pass on to any startup building a network or a marketplace.

And through Currier and Chudnovsky's past experiences and bets on successful networks like Flickr, GoodReads (sold to Amazon), AffinityLabs (sold to Monster), Maya's Mom (sold to Johnson & Johnson), Ooga quietly began to build a reputation as the investor and advisor you want as a fledgling marketplace or network.

As mentioned above, Ooga has gone on to fund a number of hot networks and marketplaces including BranchOut, Lyft, Path, Wanelo, Poshmark, Scripted and others.

Typical investments are anywhere from $5,000 to $200,000, and all of the money is Chudnovsky and Currier's, meaning there are no limited partners in Ooga. While Ooga serves as one of the most active advisors to a startup, the firm does not take board seats. In terms of stage, Ooga sometimes invests early, but will also put money into a company in a post A or B round (as was the case with Path and Lyft).

"Entrepreneurs bring us into a startup not because they just want cash, it's because we have a massive amount of knowledge about how successful networks and marketplaces are built," Currier says. And this has happened through the company's ongoing investments and creation of companies.

Building Companies And Knowledge Share

Entrepreneurs at heart, Currier and Chudnovsky realized early on at Ooga that they also wanted to turn some of their own ideas into businesses, as well. "We felt like we had enough bandwidth that we could both build companies and advise," he explains. "We both thought that the life between a focused operator and venture guy would be the best life."

In 2008, Ooga built a social gaming company called WonderHill, which created a hit game called Dragons of Atlantis. Currier and Chudnovsky ended up merging the company in 2010 with Kabam.

Another recent success came in the form of an internal web analytics and user-acquisition tool that Currier and Chudnovsky built internally which was used across the companies the duo was advising and building. Ooga realized that companies would actually pay to use this app and launched the tool, called IronPearl, earlier this year. The startup provides optimization tools that will track a user through a site or app and test which combinations work best to keep them coming back after a week or a month.

PayPal caught wind of IronPearl and quickly acquired the company in April of this year to help grow its own 100 million-plus userbase. Chudnovsky became VP of Growth at PayPal with the acquisition, and has continued in that role.

Health care is another area where Currier and Chudnovsky see the potential for the network and marketplace effect. Ooga co-founded Jiff, a platform that allows consumers and health care professionals to build personalized and private communities of care around the digital health interventions and applications they prefer and can access, from wireless sensors to mobile apps to wearable devices.

And of late, Ooga has expanded into events. Last week, the firm held NFX, a meeting of the minds in Palo Alto that brought together the CEOs, founders and product leaders of a number of successful marketplaces and networks. Currier tells us that it was a curated, off the record event that aimed to be an open forum to share ideas on network effects, how to produce viral user experiences, creating transactions that add value and more. The attendee list was a who's who of the Valley, including Dropbox's Drew Houston, Twitter co-founder Ev Williams, oDesk's Gary Swart, and Meebo's (and Googler), Seth Sternberg. Currier says the firm will hold many more of these events in the future.

At the end of the day, Currier and Chudnovsky have created a new model in venture that works for them, and gives startups more value-add than just a check or a big-name in your TechCrunch post about your funding. And Ooga Labs has been able to differentiate itself in the massive sea of angel and institutional investors in the current climate. "It's really about taking companies and ideas that don't yet have network effects and helping change that, create growth and create retention," says Currier.

In terms of expansion, the firm plans to scale out additional investments in marketplaces. And as Chudnovsky explains, Ooga Labs has become a network-effect business, facilitating the sharing of ideas around creating growth and social marketplaces. "We simply have a different way of interacting with our companies than most investors" he says.

When asked, Currier and Chudnovsky don't really know how to phrase exactly what Ooga Labs is doing. The firm is part product and design consultancy, part investment firm, part knowledge-sharing forum, and part company builder. But who says you can't do it all?

No hay comentarios:

Publicar un comentario