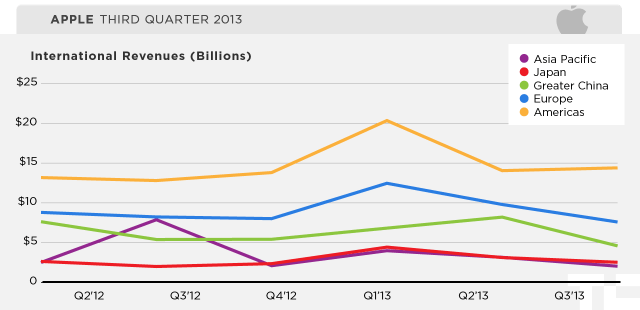

With pressure from low-cost smartphone makers on Android and other platforms, Apple today reported a plunge in its Q3 revenues in Greater China, which includes Taiwan, Hong Kong and the world's largest smartphone market, Mainland China. In that region, sales were $4.64 billion (and $4.9 billion including retail), down 14% over last year and a whopping 43% on last quarter. It's a startling contrast to the $8.2 billion reported in Q2, a record for Apple in the region, according to CEO Tim Cook, when it was the only region to grow sequentially. Overall, international sales outside of the Americas are now at just under 48%, compared to 56% last quarter and 61% in Q4 2012.

It shows that while Flurry today noted that Apple is the single most popular brand among active smartphones and tablets in China at the moment, the earnings out today are a sign that the company may be challenged to hold on to that title in the months ahead.

The rest of Apple's non-Americas regional sales categories were down as well — the one exception being Japan, which remains one of the company's stronger growth markets. Europe — still feeling the pressures of an economic recession on top of low-cost phone competition — was down to $7.6 billion, down 8% on last year and 22% on last quarter. The rest of Asia Pacific outside of China and Japan came in at $2.05 billion, down 18% on last year and 35% on last quarter. Meanwhile, Japan had revenues of $2.54 billion, up 27% on last year but down 19% on last quarter. On the conference call, Apple CFO Peter Oppenheimer noted that in Japan, iPhone sales grew 66%.

One of the big questions for Apple internationally remains how it will continue to fare going forward in emerging markets, where the company will continue to feel price pressure from low-cost handset makers. Even without launching low-cost devices that could potentially impact the company's margins — something many believe the company will do — the iPhone is already seeing its average selling prices for the iPhone decline and that continues to have an impact on its margins.

As it is, you can see in the graph below that after several quarters of growth in Greater China, the region is now firmly below Europe in terms of revenue rankings, after earlier looking like it might overtake Europe as the second-biggest region after the Americas. The latter includes Apple's biggest and home market of the U.S.

We're listening to the earnings call now and will update this with any interesting color that the company gives on the international front.

From the call. CEO Cook was defensive on questions about how well international was doing. On Greater China, where he was asked about growth being down 43% on the previous quarter, he admitted "China was weaker in the quarter," but also said that the "focus on revenue doesn't tell the complete story…In the arc [of growth] I don't get discouraged by a 90-day cycle that could have economic and other factors."

He noted that total sales for Greater China account for 14% of the company's overall revenues, and $27 billion on a trailing basis. iPad sales in the quarter were strong, 50% up over last year. He also pointed more positive signs on the ecosystem front, with now over 500,000 developers there working on iOS apps. Cook also repeated the company's commitment to double the number of retail stores in the last year.

Other international markets that Cook mentioned were growing included India, which was up 400%, Poland up 60% and Turkey up 140%.

Cook was also asked about Apple's situation in Russia, where the three big carriers, MTS, Beeline and Megafon, have stopped selling the iPhone.

Cook played this down and seemed to dismiss it altogether: "If you look at the Russian market, over 80% of phones are sold in retail outside of carrier-owned stores," he said. "Our activations in Russia set a record last quarter as the highest-ever quarter."

Of course, what this also obfuscates is how the iPhone performed relative to other devices. IDC (via Fortune) notes that Apple's share of the smartphone market declined to 8.3% in the last quarter from 9% a year ago.

Started by Steve Jobs, Steve Wozniak, and Ronald Wayne, Apple has expanded from computers to consumer electronics over the last 30 years, officially changing their name from Apple Computer, Inc. to Apple, Inc. in January 2007. Among the key offerings from Apple's product line are: Pro line laptops (MacBook Pro) and desktops (Mac Pro), consumer line laptops (MacBook Air) and desktops (iMac), servers (Xserve), Apple TV, the Mac OS X and Mac OS X Server operating systems, the iPod, the...

No hay comentarios:

Publicar un comentario